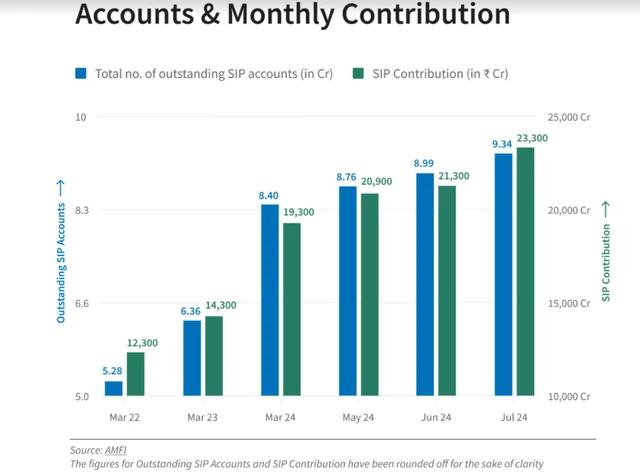

Systematic Investment Plans (SIPs) have witnessed a remarkable surge in popularity among retail investors, as the number of SIP accounts has increased by nearly 60% in the past two years, reaching over 9 crore as of July 2024, according to a study by Zerodha Fund House.

As of June 2024, total SIP AUM stood at around 20% of the overall Mutual Fund industry AUM.

)

The number of SIP accounts saw a significant 59% increase, growing from 5.28 crore to 8.4 crore between March 2022 and March 2024. “This trend continued with rise in SIP accounts in FY25 accounting to total number of outstanding SIP accounts of more than 9 crore as of July 2024,” noted the study.

SIP contributions have increased from about Rs 12,000 crore in March 2022 to about Rs 19,000 crore by March 2024. In the first few months of FY25, SIP contributions have increased to more than Rs 23,000 crore, representing an increase of around 89% from March 2022.

)

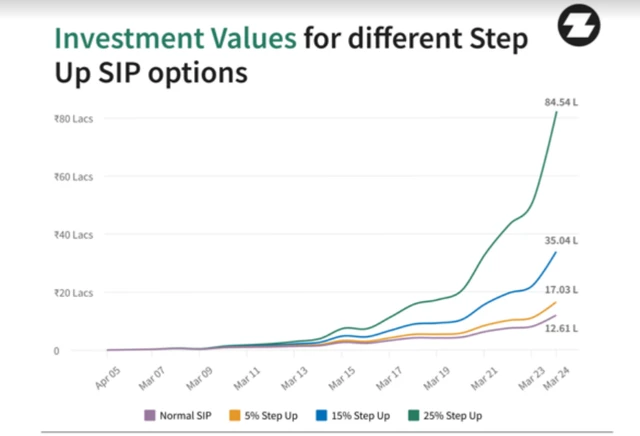

With a 5% annual step-up it can grow to about Rs 17 lakh by March 31, 2024. The value increases to Rs 35 lakh with an annual step-up of 15%, and to an impressive number close to Rs 84 lakh with an annual step-up of 25%.

This information is provided for general informational purposes only and does not constitute financial advice. Investing in mutual funds involves risks, and past performance is not indicative of future results.

First Published: Aug 27 2024 | 5:26 PM IST